Mga spotlight

Risk Manager, Internal Auditor, Accreditation Lieutenant, Accreditation Manager, Compliance Director, Compliance Operations Manager

Every organization on Earth has some sort of financial structure, whether it’s a “mom and pop” store, a nonprofit, a company, an insurance firm, or a government agency. And whenever money is involved, you can bet there are rules and regulations about how that money gets used. That’s why most organizations have at least one dedicated Financial Compliance Officer on staff to keep them out of legal trouble.

Financial Compliance Officers carefully review balance sheets, income statements, and other financial documents. They meticulously screen for discrepancies and ensure compliance with applicable federal and state regulations (plus any other guidelines they’re asked to watch out for). Their goal is to find and prevent oversights, errors, and fraud that could impact the integrity of their employer’s finances.

“Ang aking trabaho ay magsagawa ng mga pagsusuri sa aming mga kasalukuyang patakaran, pamamaraan, kasanayan, at daloy ng trabaho upang maunawaan kung kami ay sumusunod sa lahat ng mga batas ng estado at pederal. Kung makakahanap ako ng lugar na mapapabuti ay tumutulong ako sa pagbuo ng mga programang idinisenyo upang mabawasan ang panganib. Sinusuri at sinusuri ko rin ang mga kontrata ng vendor upang matukoy kung maibibigay ng kumpanya ang mga serbisyong kailangan, sapat na naghahanda upang suportahan ang aming pangkalahatang mga pangangailangan, at pagkatapos ay bumuo ng mga aktwal na kontrata para sa lagda. Bilang isa sa mga mas mahalagang aspeto ng aking trabaho, nagsasagawa ako ng buwanang pagtatasa ng panganib sa mga kasanayan sa negosyo. Tumutulong ako na tukuyin kung saan maaaring gawin ang mga pagpapabuti at pagkatapos ay ipasa ang mga ito sa mga tagapamahala at tumulong na bumuo ng mas mahusay na proseso ng dokumentasyon at mga pagsusuri sa kontrol sa kalidad. “ Jarrett Wright Carson, Compliance Manager, Alaska USA FCU

- Playing a critical role in preventing financial misconduct and crises

- Opportunities to work in a wide range of organizations

- Collaborating with teams to enhance compliance and risk management

"Nakikita ko ang pakinabang ng aking trabaho sa kakayahan ng aking mga empleyado na tumulong sa mga customer at iba pang mga departamento sa loob ng aming organisasyon. Nagagawa kong magturo, bumuo, at mag-coach sa aking mga empleyado sa pagiging susunod na pangkat ng pamamahala na mamumuno sa kumpanyang ito. " Jarrett Wright Carson, Compliance Manager, Alaska USA FCU

Oras ng trabaho

- Financial Compliance Officers typically work full-time, with the potential for overtime during audits and examination periods.

Mga Karaniwang Tungkulin

- Develop and implement risk management strategies and compliance audit plans, procedures, documentation, databases, and tracking systems

- Forge relationships with stakeholders to ensure effective communication and cooperation

- Conduct internal audits, self-assessments, and thorough reviews of financial statements and records to ensure compliance with regulations and identify potential risks and irregularities

- Prepare detailed reports of findings and recommend corrective actions

- Monitor ongoing compliance; follow up on previous findings to make sure they’ve been addressed

- Evaluate the effectiveness of internal controls. Recommend improvements, as needed

- Ensure institutions adhere to federal and state laws and regulations, and submit accurate and timely regulatory filings and reports

- Ensure compliance with anti-money laundering and know-your-customer regulations

- Collaborate with legal and regulatory teams; liaise with external regulatory bodies and auditors

- Train staff on compliance requirements and best practices

Investigate complaints and potential violations of financial regulations - Implement and oversee whistleblower policies and procedures

- Conduct special investigations into potential financial misconduct or regulatory breaches

Karagdagang Pananagutan

- Stay current with financial regulations and examination techniques

- Engage in professional development opportunities

- Provide guidance and support to junior officers and other staff

- Assist in the preparation for regulatory examinations and audits

"Ang aking karaniwang araw ay nagsisimula sa isang pulong. Sinisikap kong palaging magkaroon ng isang pulong ng pangkat upang bigyang-priyoridad ang mga kailangang gawin sa loob ng aking dibisyon. Sa pulong na ito ay nakatuon ako sa mga priyoridad ng trabaho, tinitiyak na ako at ang aking koponan ay sa parehong pahina, at pagkatapos ay tiyaking alam ko kung may anumang mga isyu na maaaring lumitaw. Ang komunikasyon ay susi. Pagkatapos ng paunang pulong na ito, kadalasan ay sinusuri ko ang aking pang-araw-araw at production tracker. Ito ay nagpapahintulot sa akin na makita kung ano ang mayroon ako sa aking "to do list", ang mga priyoridad, at kung sino ang nangangailangan nito. Pagkatapos ay sisimulan kong piliin ang item na may pinakamataas na priyoridad o kung ano ang maaaring gawin sa pinakamabilis at dahan-dahang pag-atake sa listahan. Kung minsan ay mangangailangan ito ng malawak na pagbabasa, mga kontrata, mga legal na dokumento, mga batas ng pederal o estado, atbp. Pagkatapos ng tanghalian ay nagpalit na ako ng mga gamit at nagsimulang tumuon sa aspeto ng pagsasanay ng ginagawa ng aking koponan. Bumuo kami ng mga programa sa pagsasanay at nagbibigay-daan ito sa akin na tumutok sa lugar na ito nang walang maraming distractions. Sa pagtatapos ng araw, nagsasagawa ako ng impormal review ng kung ano ang team ko ha Nagawa ko na, kung ano ang nagawa ko, at pagkatapos ay bumuo ng isang plano para sa susunod na araw at ang aking mga pagpupulong sa umaga." Jarrett Wright Carson, Compliance Manager, Alaska USA FCU

Soft Skills

- Aktibong pakikinig

- Kakayahang umangkop

- Analitikal

- Nakatuon sa pagsunod

- Kritikal na pag-iisip

- Mabusisi pagdating sa detalye

- Disiplina

- Katalinuhan sa pananalapi

- Integridad

- pasensya

- Pagtitiyaga

- Pangungumbinsi

- Pagpaplano at organisasyon

- Mga kasanayan sa paglutas ng problema

- Pag-aalinlangan

- Mukhang makatarungan

- Malakas na kasanayan sa komunikasyon

- Pagtutulungan ng magkakasama

- Pamamahala ng oras

Teknikal na kasanayan

- Data analysis and interpretation, using tools like Microsoft Excel, Tableau, or SPSS to identify trends and anomalies

- Familiarity with regulatory compliance software such as SAS, MetricStream, or IBM OpenPages for monitoring and ensuring compliance

- Knowledge of financial regulations and standards, utilizing tools like Wolters Kluwer Compliance Solutions

- Proficiency in financial analysis and auditing techniques and programs, utilizing software like QuickBooks, SAP, or ACL Analytics for thorough financial reviews

- Report writing, using Microsoft Word or Google Docs

- Risk management, employing tools like Archer or RiskWatch to develop and implement effective risk mitigation strategies

- Understanding of banking and financial systems, using platforms like Fiserv, Jack Henry, or Oracle Financial Services to manage and oversee banking operations

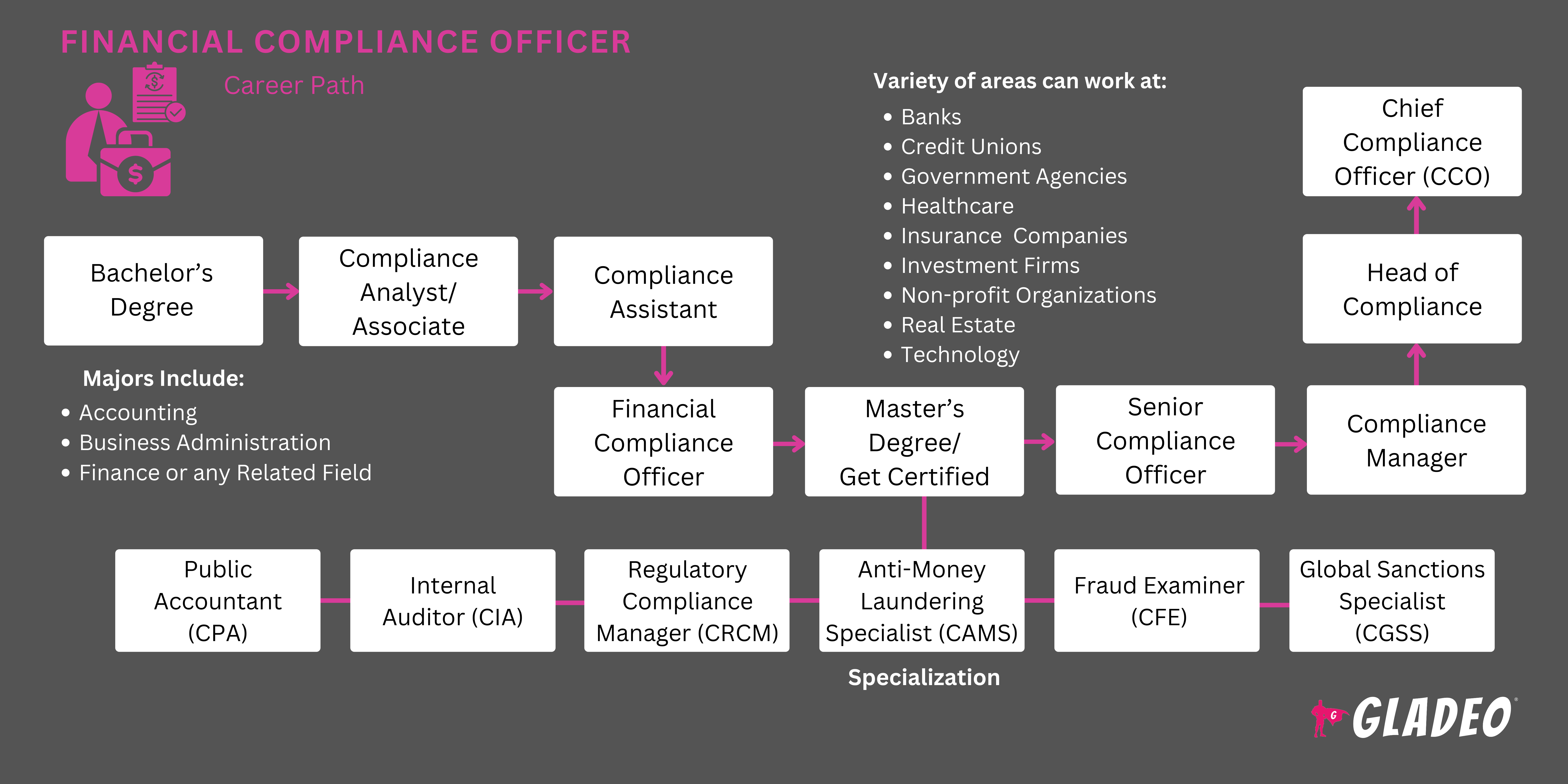

- Banks and credit unions

- Companies and corporations

- Financial consulting firms

- Mga ahensya ng gobyerno

- Mga kompanya ng seguro

- Investment firms

- Mga nonprofit na organisasyon

Financial Compliance Officers are expected to maintain high standards of accuracy and integrity. Their role is crucial in identifying and mitigating risks within their employing institutions. There’s a ton of pressure to ensure compliance and avoid fines or sanctions, so they must be vigilant and detail-oriented because even minor oversights can lead to significant repercussions.

The job requires extensive research and continuous education to keep up with changing laws and regulations. Hours can be long and the role can be stressful at times, but there’s job satisfaction from protecting organizations and consumers from financial misconduct. Also, the skills and experience gained in this role can open doors to advanced positions within the field!

The financial industry is increasingly utilizing technology to improve compliance processes. Automation, artificial intelligence, and blockchain are becoming integral in detecting irregularities and ensuring transparency. Regulatory Technology solutions are on the rise, helping compliance officers manage regulatory requirements by streamlining reporting, enhancing risk management, and reducing the time and cost of compliance activities.

There’s also a growing emphasis on sustainable finance and environmental, social, and governance regulations. Financial compliance officers are thus charged with ensuring their institutions adhere to these strict standards and exhibit more responsible corporate behavior!

- Paglalaro ng mga board game at paggalugad ng mga patakaran.

- Pagbabasa ng mga libro at paglutas ng problema.

- Pagpapanatiling maayos ang mga personal na gamit.

- A bachelor’s degree in finance, accounting, business administration, or a related field is typically required to get started. However, relevant work experience is also essential. Some companies offer on-the-job training, internships, or other mentorship programs, but most Financial Compliance Officers still have to work their way up to the role

- Workers require in-depth knowledge of finance, auditing, compliance, financial regulations, and standards. They should also be proficient with compliance and financial analysis software and must understand risk management principles and practices

- Continuous professional development (via classes, certifications, conferences, workshops, and seminars) is needed to stay updated on regulatory changes and industry best practices

- Advanced positions may require a master’s degree and/or additional certifications such as:

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Regulatory Compliance Manager (CRCM)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Certified Global Sanctions Specialist (CGSS)

- Look for reputable, accredited college programs in finance, accounting, or business administration, with programs emphasizing financial regulations, auditing, and compliance.

- Decide early if you plan to pursue a master’s. It may be easier to complete a bachelor’s and master’s at the same school, perhaps via a dual program.

- In addition, consider the following:

- Costs of tuition (including in-state versus out-of-state tuition rates).

- Discounts or scholarship options.

- Whether federal aid will help cover costs or not.

- Whether to enroll in an on-campus, online, or hybrid program.

- The experience and achievements of the faculty.

- Opportunities for internships or cooperative learning.

- Graduate job placement stats and details about the program’s alumni network.

- Mag-aral ng mabuti sa math, finance, economics, statistics, business, physics, at computer science/programming classes

- Magboluntaryo para sa mga aktibidad ng mag-aaral kung saan maaari kang mamahala ng pera at matuto ng mga praktikal na kasanayan

- Isaalang-alang ang pag-aplay para sa mga part-time na trabaho sa accounting o pananalapi

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working compliance officers to learn more about their jobs

- Maghanap ng mga internship at mga karanasan sa kooperatiba sa kolehiyo

- Subaybayan ang mga pangalan at impormasyon sa pakikipag-ugnayan ng mga taong maaaring magsilbing mga sanggunian sa trabaho sa hinaharap

- Study books, articles, and video tutorials related to financial laws. Participate in online discussion groups

- Makipag-ugnayan sa mga propesyonal na organisasyon upang matuto, magbahagi, makipagkaibigan, at mapalago ang iyong network (tingnan ang aming listahan ng Mga Mapagkukunan > Mga Website)

- Knock out any relevant certifications as soon as you can to bolster your credentials and make you more competitive in the job market

- Kumuha ng ilang praktikal na karanasan sa trabaho sa ilalim ng iyong sinturon bago mag-apply, kung maaari. Ang mga trabahong nauugnay sa pananalapi, accounting, at negosyo ay magiging maganda sa isang aplikasyon

- Hindi kailangan ng master para makapagsimulang magtrabaho sa larangang ito, ngunit maaaring mauna ka ng graduate degree sa kompetisyon

- Let your network know you are looking for work. Most job opportunities are still discovered through personal connections

- Tingnan ang mga portal ng trabaho gaya ng Indeed , Simply Hired , at Glassdoor , pati na rin ang mga page ng karera ng mga kumpanyang interesado kang magtrabaho

- Check out a few online Financial Compliance Officer resume templates for formatting and phrasing ideas

- Screen job ads carefully and only apply if you’re fully qualified. Include keywords in your resume, such as:

- AML/KYC Compliance

- Artificial Intelligence in Compliance

- Audit Procedures

- Blockchain Technology

- Compliance Databases

- Data Analysis (Excel, Tableau, SPSS)

- Pagsusuri sa pananalapi

- Financial Reporting

- Financial Systems (QuickBooks, SAP, Fiserv)

- Internal Controls

- RegTech Solutions

- Regulatory Compliance Software (SAS, MetricStream, IBM OpenPages)

- Risk Management (RSA Archer, RiskWatch)

- Ang mga apprenticeship na may kaugnayan sa pananalapi o mga karanasan sa kooperatiba ay maaaring makatulong sa pagpasok ng iyong paa sa pintuan. Maganda ang hitsura nila sa mga resume at maaaring magbunga ng ilang personal na sanggunian para sa ibang pagkakataon

- Move to where the most job opportunities are! Some states with the highest employment level for finance jobs are New York, California, Texas, Illinois, and Florida

- Maraming malalaking kumpanya ang kumukuha ng mga nagtapos mula sa mga lokal na programa, kaya humingi ng tulong sa programa o career center ng iyong kolehiyo para sa pagkonekta sa mga recruiter at job fair

- Nag-aalok din ang mga career center ng tulong sa pagsulat ng resume at mock interviewing !

- Ask former teachers and supervisors if they’ll serve as personal references. Don’t give out their contact info without permission

- Gumawa ng account sa Quora para magtanong ng mga tanong sa payo sa trabaho mula sa mga manggagawa sa larangan

- Financial Compliance Officer interview questions to prepare your responses. Sample questions might include: “What are the key regulatory frameworks that a Financial Compliance Officer should be familiar with?” or “How do you handle conflicts between compliance requirements and business objectives?”

- Magdamit ng angkop para sa tagumpay sa pakikipanayam sa trabaho!

"Magkaroon ng isang mabisang resume na hindi lamang naglilista ng mga responsibilidad sa trabaho. Pag-usapan kung ano ang iyong ginawa, at kung gaano mo ito nagawa. Tumutok sa ACTION, EPEKTO, at RESULTA. Ano ang ginawa mo, ano ang nagawa nito para sa kumpanya , at kung ano ang huling resulta ng iyong mga aksyon. Ang iyong resume ay dapat hangga't kinakailangan upang kumbinsihin ang mambabasa na ikaw ang tamang tao para sa trabaho." Jarrett Wright Carson, Compliance Manager, Alaska USA FCU

- Be resilient and maintain your professionalism at all times. Build your reputation as an ethical Financial Compliance Officer who offers feasible ideas and solutions to problems

- Constantly listen to and learn from other seasoned professionals so you can avoid issues they may have encountered

- Demonstrate a willingness to assume more responsibility and tackle increasingly complex tasks

- Knock out additional education and training to improve your technical skills

- Keep growing your professional network. Attend events, conferences, and workshops

- Seek feedback from supervisors and colleagues to identify areas for improvement

- Consider relocating or switching employers if necessary to achieve career goals

- Stay informed about industry trends and changes by reading industry publications and joining professional associations

- Develop your analytical skills to analyze complex data and identify potential compliance risks. Learn about new programs and technologies

- Cultivate strong communication skills to explain complex regulations clearly to different stakeholders

- Demonstrate leadership by leading compliance projects, mentoring junior staff, and contributing to your team’s success

- Be detail-oriented in reviewing documents, monitoring compliance activities, and ensuring all regulatory requirements are met

- Build strong relationships with regulatory bodies to better understand their expectations and facilitate smoother compliance audits and inspections

- Foster a culture of compliance within your organization by training staff, promoting ethical behavior, and ensuring everyone understands the importance of compliance.

"Sakripisyo at Dedikasyon. Isakripisyo ang mga bagay na hindi mo kailangan o hindi dapat gawin para sa mga bagay na alam mong tutulong sa iyo na maging mas mahusay. Maging nakatuon sa iyong plano. Ang iyong plano ay makakatulong sa iyo na makamit ang iyong pangkalahatang mga layunin." Jarrett Wright Carson, Compliance Manager, Alaska USA FCU

Mga website

- American Bankers Association

- American Compliance Association

- Association of Certified Anti-Money Laundering Specialists

- Association of Certified Chief Financial Officers

- Bankers Online

- Compliance & Ethics Blog

- Compliance Today

- Compliance Week

- Corporate Compliance Insights

- Awtoridad sa Regulatoryong Industriya ng Pinansyal

- Global Association of Risk Professionals

- Institute for Financial Markets

- Institute of Internal Auditors

- International Compliance Association

- Journal of Financial Compliance

- National Association of State Boards of Accountancy

- National Society of Compliance Professionals

- Regulatory Compliance Watch

- Risk & Compliance Journal

- Risk Management Association

- Securities and Exchange Commission

- Thomson Reuters Compliance Learning

Mga libro

- Financial Regulation: Law and Policy by Michael S. Barr

- Principles of Financial Regulation, by John Armour, et. al.

- The Essentials of Risk Management by Michel Crouhy, et. al.

Financial Compliance Officers bear professional responsibility for keeping their organizations compliant with numerous regulations. Sometimes, mistakes still happen and companies get fined or even prosecuted. In rare cases, the compliance officers themselves may face personal liability if they also made mistakes. As a result, it is important to weigh the career’s rewards with its potential risks!

For those who want to explore alternative career paths that rely on similar skills, check out our list below.

- Customs Broker

- Espesyalista sa Pamamahala ng Dokumento

- Environmental Compliance Inspector

- Equal Opportunity Representative

- Financial Analyst

- Forensic Accountant

- Government Property Inspector

- Internal Auditor

- Quality Control Systems Manager

- Regulatory Affairs Manager

- Risk Manager

Ang Pagsunod sa Bangko ay bahagi ng mas malaking grupo ng mga Financial Examiner. Ang lahat ay tungkol sa pagtulong sa negosyo na mag-navigate hindi lamang sa mga legal na komplikasyon, kundi pati na rin sa mga moral na komplikasyon. Kung ikaw ay isang indibidwal na gustong tumulong na maiwasan ang pandaraya, o iba pang problema sa pananalapi, ito ay isang mahusay na landas sa karera. Ang mga indibidwal na ito, sa abot ng kanilang makakaya, ay makakatulong sa mga organisasyon na umunlad habang tunay na tinutulungan ang kanilang mga customer.

Kakailanganin mong maging mahusay sa mga legal na usapin, pati na rin magkaroon ng ilang kaalaman sa mundo ng pananalapi.

Newsfeed

Mga Tampok na Trabaho

Mga Online na Kurso at Tool